skip to Main Content

- While entrepreneurs often focus on profitability, cash flow is arguably the more important consideration

- The benefits of tracking how money is coming into your business and how it is being spent

- Calculations involved in calculating and predicting cash flow

- Grant funds do not need to be repaid and can provide targeted support for your small business

- Where to look to find grant opportunities

- Preparing a grant application and increasing your chances of success

- How keeping detailed records can help you assess the financial health of your business

- A look at the balance sheet, income statement, and cash flow statement

- View sample statements to view how this information is presented

- Employers are required by law to pay their employees, but unexpected circumstances may leave you with too little cash to make payroll

- Communicating the situation is essential, after which you can pursue one of several potential solutions

- An inability to meet payroll may be a warning sign that you need to make changes to your business strategy

- Keeping track of your business expenses and income is crucial for assessing your business strategy and profitability

- Several free online tools are available to business owners

- Help forecast future cash flows, track down late payments, and turn the tedious task of getting paid into something much easier

- The definition and importance of bookkeeping

- For those starting a business and those who haven’t hired an accountant

- Learn the basics of small business accounting

- Deciding whether you should hire a professional accountant or balance your own books

- For any kind of business organization

- Avoid costly financial and tax mistakes

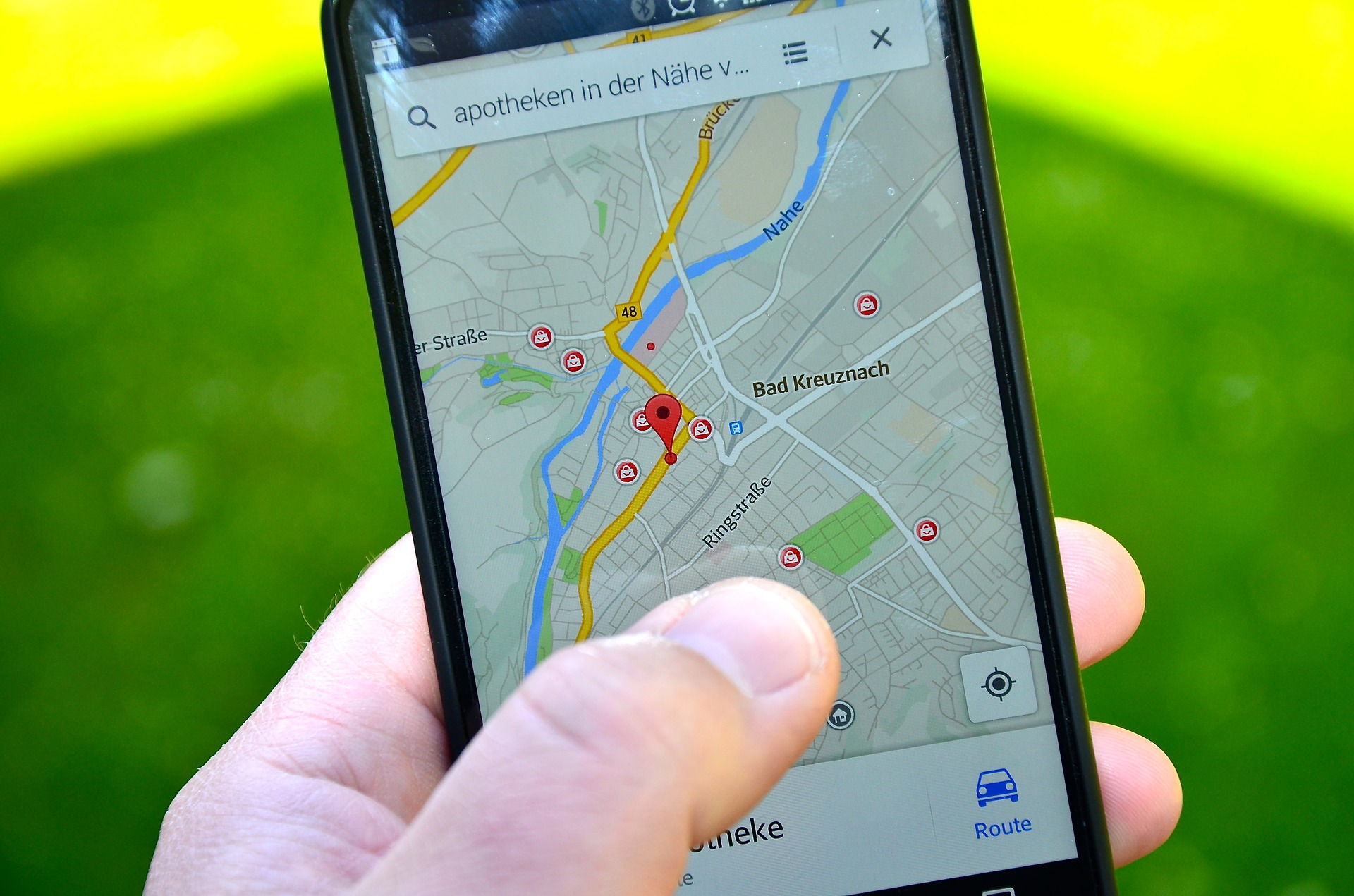

- Factors that go into choosing a business location and questions that entrepreneurs should ponder

- For those starting or expanding a business

- Also a resource for Connecticut business location selection